Market: checking the bottom

June, 2015, at the St. Petersburg Economic Forum the top ranking officials pronounced that the crisis in Russia finished. Well, may be not completely finished, but the acute phase already passed. Is that true? May be, at least ruble renewed in the middle of August its minimum record to euro and dollar.

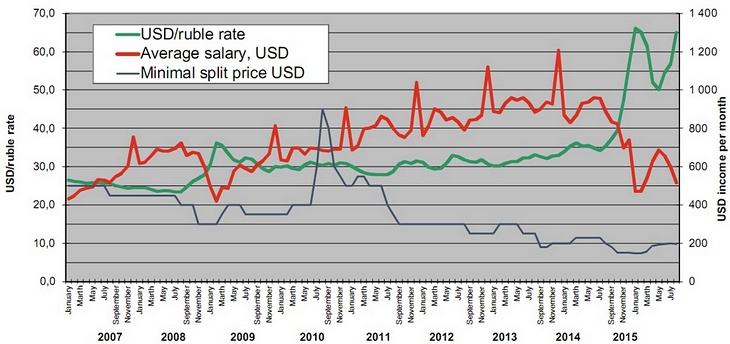

Ruble fell down following the price of a barrel of oil and then slightly played back when the oil price grew again. Why exactly these factors are so important for the market of air conditioners, but not the weather, the volume of new construction and so on? The answer is simple. The market is at that stage of development when the main buyer is a man with low income denominated in rubles, buying his first air conditioner. Any DROP in his income (even the lack of the growth prospects) immediately affects all non-food markets. With the reduction of real income by 20-30%, people who spend more than 50% of their earnings on food, utilities and transport, buy air conditioners, consumer electronics, clothing and other „luxury“ 2-3 times less. And this, in turn, affects the trade, which is a major corporate customer. Shops are closing, office space is reducing, cafes where the office people got used to lunch are fading. As a result, the corporate segment of the market shrinks following the DROP in the income of people. Even the needed replacement of equipment often is postponed. At the same time, Russian market of air conditioners is still lucky because the local peak of the ruble exchange rate happened in May-June which is precisely the period of the maximum demand for HVAC equipment (Diagram 1).

Diagram 1. Average income of Russian population in dollar terms, ruble to dollar exchange rate and the lowest price of the air conditioner.

Sources: Rosstat, Lytvynchuk Marketing

Second factor that strongly influences demand: the weather

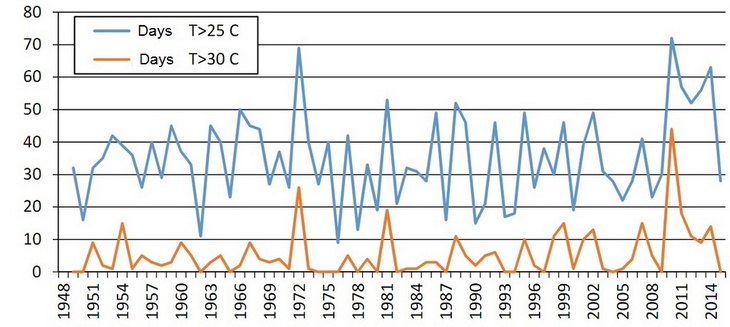

What happened in 2015 at the Divine Weather Department? While the Volga Region suffered from in the heat wave, the consequence of five hottest years in Moscow, the biggest market, interrupted. Before such abnormality occurred only once for the all time of meteorological observations, in the years 1966-1968 (Diagram 2). At the same time, despite the feeling of the Moscow citizens who already got accustomed to the heat, the summer 2015 was not so cold. It matched the climate normals.

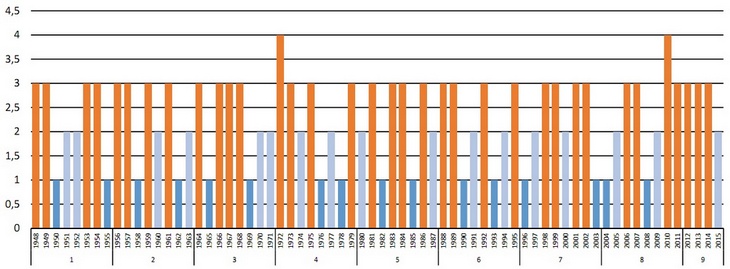

The „rule of four years“ (two hot summers, one moderate and one cold), which worked from 1980 to 2011, was broken, but the less strict „rule of eight years“ (four hot summers, two cold, two moderate) may stand. To do this in the next four years should be two cold summers, one hot and one moderate. As it could be seen on the Diagram 3, three years without heat is not a rare phenomenon. At the same time, since 1948, there were two sets of six years without a cold summer and one set of seven, which is still ongoing. It would be clear in a year, whether the climate returns to regular, or the heat becomes the normal.

Diagram 2. Moscow. Number of days with temperature above 25 and 30° C within the year

Sources: Data of Weather Station TSKhA processed by Lytvynchuk Marketing

Despite the fact that the influence of climatic factors on the saturated markets is a little less than the growing ones, the weather can seriously distort the dynamics of sales. For example, in 2015, when air-conditioners in Moscow and Central Russia were switched on for only 3-7 days during the summer, many owners decided not to change the failed equipment. Someone just could not realize that his AC did not work well. Someone else looking out of the window and then in to his wallet decided that the replacement would have to wait as the air conditioner is not so needed in this season. Clear, it is a pent-up demand. But now, when the market is checking the bottom, some extra customers are much more important for the industry than in a couple of years.

Diagram 3. Hot, moderate and cold years in Moscow, by the number of days with the temperature above +25°C from May16 to July15, each year in Moscow. Grouped by eight years.

Sources: Data of Weather Station TSKhA processed by Lytvynchuk Marketing

Third factor: new construction

When we consider the situation in the construction industry, a lot depends on the point of view. In 2014, Russia set a record in the housing commissioned: 80.4 million square meters of living space. That is more than in the USSR in the best Soviet years. In the first months of 2015 construction bit the record of 2014, but since June there was a noticeable slow down. The projected annual figures are 7-10% lower than of 2014, but still higher than of successful 2013.

It should be also taken into account that usually new apartments are commissioned without any finishing. Later, finishing lasts for a period from six months to a year and a half, during which the building is actively accreted with air conditioners. So, the peak volume of housing construction should give an increase in the demand for air conditioners in 2015-2016.

In 2013-2015, it was annually commissioned approximately one million apartments. The percentage of air-conditioned housing differs from region to region. In the south of the country it exceeds 50%, in Siberia only 5%. If we take the average figures, we get about 150-250 thousand air conditioners per one million commissioned apartments, accounting the fact that in one apartment can be installed more than one air conditioner.

At the same time, new construction in the corporate segment is seriously getting down. The turnover in construction fell down in the first 7 months of 2015 by 7.7% in ruble terms as compared with the same period of 2014. Taking into account the price rise of construction materials, the decline in physical terms is very significant. The import figures of AHU and VRF say a lot about the scale of the DROP of the non-residential construction market. The importation decline in the first 7 months of 2015 was 47% and 42% respectively, compared to the same period of the previous year.

So, what do we have as a result?

Gloomy result

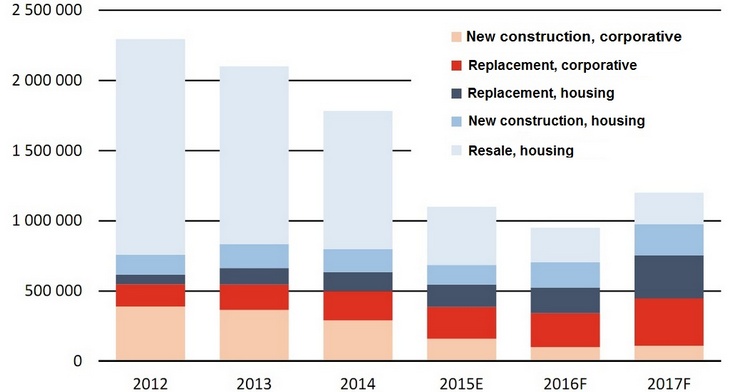

To make it clear, we divide the market into 5 main segments.

The first segment is the replacement of equipment in the housing and corporate sectors. Let’s assume that the air conditioner life cycle is about 13 years. In 2015-2016 will be replaced about 80% of failed air conditioners, in 2017 — 90%, and later the replacement will match the amount of failed AC.

The second segment is sale fore new buildings, both housing and corporate segment. In the new buildings in 2014-2016 forms pent-up demand, this will be covered in 2017-2018. We assume that the low purchasing power and cool weather in the next two years would not stimulate demand.

Finally, sales for inexpensive housing are getting down because people with income below the average would not become richer, and the middle class and more reach people are for the most part already „air-conditioned“. So, we have something like Diagram 4.

Diagram 4. Sales of all types of air conditioners by the market segments

Sources: Data of Weather Station TSKhA processed by Lytvynchuk Marketing

Predicting development of the market that depends on the weather and economy is an ungrateful task. At the same time, Diagram 4 clearly shows that the proportion of segments that can be calculated with some probability grows rapidly. These segments are the equipment replacement and new construction,. If in 2012 they counted for 33%, in 2015 already 62%, and by 2017 their proportion will rise to 71%.

The Diagram also clearly shows that the corporate segment will be affected by the crisis less than the housing one. The last 7 years, the sales there are on the level of around 550,000 air conditioners per year, and after the current recession will return to the previous level already in 2018.

As far as the residential sector is concerned, sales recovery there will be slower due to the high saturation of the market which grew up too fast after 2005. Sales will reach the level of 1.2-1.3 million air conditioners per year by 2019-2020, and then will grow by about 4-5% per year, with a slight correction to the weather.

George Lytvynchuk,

Lytvynchuk Marketing, General Director